-

Many business owners assume that bad credit automatically disqualifies them from fast or urgent funding. In reality, urgent business funding with bad credit is possible in certain situations — especially through alternative funding options that focus more on business performance than personal credit scores. This guide explains how fast funding works for credit-challenged businesses, what…

-

When businesses need capital quickly, they often search for fast business funding — not necessarily funding that arrives the same day, but options that move significantly faster than traditional bank loans. This guide explains what fast business funding really means, which options offer the quickest turnaround, and how to choose the right solution when speed…

-

When cash flow issues can’t wait, many business owners start searching for same-day business funding. Whether it’s payroll, inventory, an emergency expense, or a time-sensitive opportunity, the question is usually the same: Can I actually get business funding today? This guide explains what same-day business funding really means, which options move the fastest, who typically…

-

The Illusion of a “Guaranteed” Loan When your credit score has taken a beating, and your business needs funding fast, those ads claiming “business loan bad credit guaranteed” can feel like a lifeline. But that word — guaranteed — hides a dangerous promise. In truth, no legitimate lender can offer a guaranteed business loan without…

-

Late at night, after the shop lights go out, many business owners sit with the same question: how can I keep growing when my credit score is holding me back? A score under 600 can feel like a wall — it shuts off the traditional loan routes, creates self-doubt, and forces you to get creative.…

-

Why Expansion Funding Looks Different Today Expansion is both the most exciting and the most precarious chapter in a business owner’s journey. You’ve proven your product, found your audience, and built a rhythm that works—now the question is how to scale without putting it all at risk. Traditionally, this meant another sit-down at a local…

-

When Assets Aren’t an Option It’s a tough moment for any business owner: sitting at a bank meeting, hearing that to unlock working capital, you’ll need to pledge your home, your car, or your inventory. For many entrepreneurs, that’s simply not possible—or not worth the risk. Yet growth still demands funding, and payroll, equipment, or…

-

What a Merchant Cash Advance Really Is Most business owners hear the term “merchant cash advance” (MCA) and either feel instant relief or immediate suspicion. It’s often described as a quick source of working capital—but rarely explained clearly. The truth sits somewhere between myth and misunderstanding. A merchant cash advance isn’t a loan in the…

-

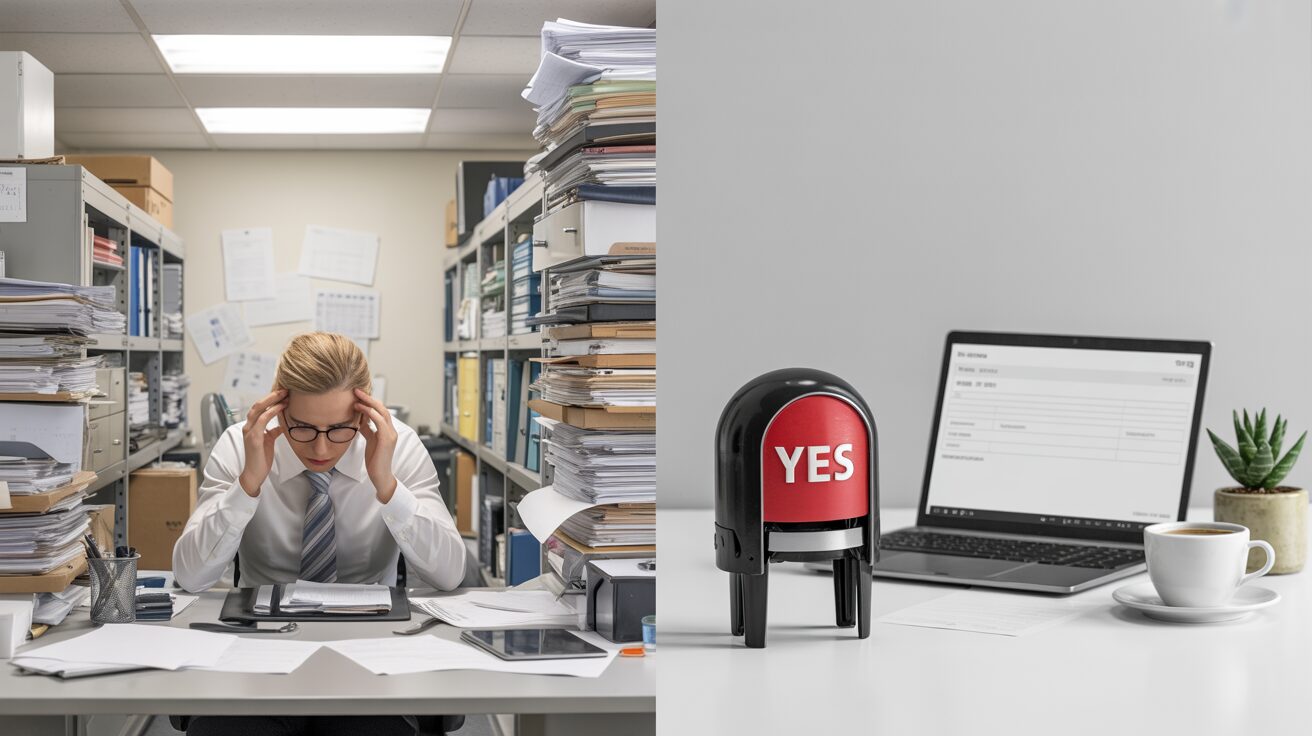

When most small business owners think about applying for a loan, the first image that comes to mind is usually paperwork — lots of it. Bank statements, tax returns, credit scores, years of financial records. It’s no wonder so many give up before they even begin. Yet, not all loans are wrapped in red tape.…

-

When a business hits its growth stride, it’s both exhilarating and terrifying. Orders start flooding in, new customers appear faster than your systems can keep up, and suddenly what once felt steady now feels like a sprint. Growth, as exciting as it is, consumes cash at an alarming rate. The challenge isn’t just finding money—it’s…